The Government Accountability Office (“GAO”) recently released its Bid Protest Annual Report to Congress for Fiscal Year 2022. The report reflects that prior years’ trends continue. Namely, while the total number of bid protest filings continues to decline, the percentage of protests obtaining some form of positive relief is relatively high and holding steady.

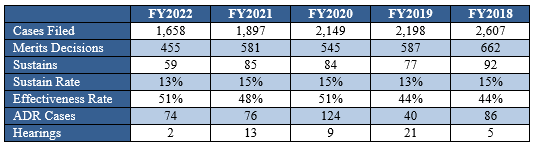

In the chart below, we summarize GAO’s most recent release of its protest statistics for the past five fiscal years:

The Annual Report reflects that GAO had yet another active year of protest activity. Below are a few key observations:

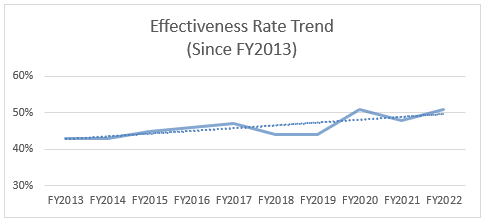

1. Effectiveness Rate Rises to All-Time High: This year’s report indicates that protesters continue to enjoy a high success rate, reflected in the “Effectiveness Rate.” GAO utilizes this measurement to determine the rate at which protesters obtain some form of relief, typically either voluntary corrective action or a sustained protest. The Effectiveness Rate increased slightly from 48% to 51% in FY2022, which is greater than the 5-year average of 48%. The historical trend over the past ten years reflects that the Effectiveness Rate remains steady, but with a positive trend line (reflected below):

The Effectiveness Rate for FY2022 of 51% matches a previous record set in FY2020. It is remarkable that over half of all protest filings achieve some level of success. This illustrates that protests continue to be an effective tool for contractors in challenging agency decisions following a competitive procurement.

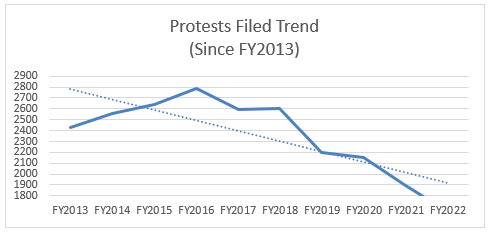

2. Bid Protest Filings Drop Significantly (Again): While the number of protest filings fell 12% in FY2022, this does not represent the largest year-over-year decline. That came in FY2019, when protest filings dropped 16%. However, GAO’s protest statistics reflect a steep decline in total filings that has persisted in recent years.

Since FY2018, the total filings have dropped by an astonishing 36%. This is reflected by a general year-over-year decrease in total filings after a peak of 2,789 filings in FY2016 (reflected below):

The total filings in FY2022 is the lowest in fourteen years, and nearly matches an all-time low in GAO history. The sustained decrease in filings may be attributed to a number of factors. First and foremost, impacts from the COVID-19 pandemic and economic conditions continues to affect contractors’ litigation and protest strategies. We also continue to see an increased use of Other Transaction Authority (“OTA”) in the Government’s acquisition strategy, which cannot be protested at GAO. Finally, pursuing protests before the Court of Federal Claims, and foregoing a protest at GAO, is increasingly seen as a preferred strategy.

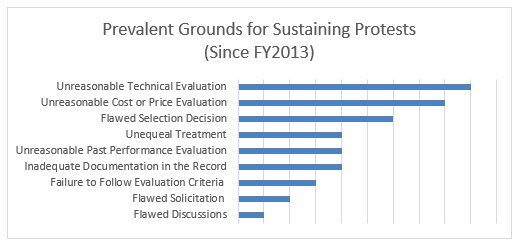

3. Familiar Grounds for Sustaining Protests: Each year, GAO highlights the “Most Prevalent Grounds for Sustaining Protest.” In FY2022, the most common bases were: (i) unreasonable technical evaluation; (ii) flawed selection decision; and (iii) flawed solicitation. For the most part, these sustained grounds generally align with GAO’s top reasons for sustaining protests since FY2013 (reflected below):

It comes as no surprise that protesters continue to challenge, and GAO demonstrates a willingness to scrutinize a procuring agency’s technical and cost/price evaluations. However, it is noteworthy that pre-award protests appeared on the GAO’s list for just the third time since FY2013. This is likely due to some high-profile challenges to large multiple-award procurements that occurred in FY2022. Nevertheless, this serves as a great reminder that contractors should diligently review solicitations to ensure the terms are not unduly restrictive of competition, or otherwise ambiguous and unclear.

Subscribe to get our Insights delivered to your inbox.

This publication is designed to provide general information on pertinent legal topics. The statements made are provided for educational purposes only. They do not constitute legal or financial advice nor do they necessarily reflect the views of Holland & Hart LLP or any of its attorneys other than the author(s). This publication is not intended to create an attorney-client relationship between you and Holland & Hart LLP. Substantive changes in the law subsequent to the date of this publication might affect the analysis or commentary. Similarly, the analysis may differ depending on the jurisdiction or circumstances. If you have specific questions as to the application of the law to your activities, you should seek the advice of your legal counsel.